Literature review on COVID19’s Impact over the Global Economy: A Statistical Analysis

This blog provides an overview of the literature assessment of the pandemic’s effects on the international economy by summarising the pandemic’s effects on different segments of the global economy, with a focus on three economic sectors:

- Primary sectors – Industries that depend on raw materials from natural sources such as the Agricultural Industry, and Petroleum & Oil industry.

- Secondary sectors – Manufacturing industries such as Construction, and Supply of Gas, Water, and Power

- Tertiary sectors – Service industries such as Education, Finance, Healthcare, and Pharmaceutical Industries; Hotel, Tourism, and Aviation; Sports Industry; Real Estate and Housing Sector; Information Technology, Media, and Research and Development; and Food Sector

Before you start writing an impactful literature review, you must plan out the work, and list down essential steps and questions you want to clear. These are essential steps before starting your research.

Impact on global economic development

The world’s top 10 economies are on the verge of collapse, including the United States, Japan, Germany, China, the United Kingdom, France, India, Italy, Brazil, and Canada. Furthermore, financial markets all around the world have been crushed, and tax revenue sources have come to all-time low.

This research shows the impact of infection-related epidemics on worldwide economic development. It analyzes the current situation and states that the virus is expected to outstrip global economic growth by more than 2.0 % per month.

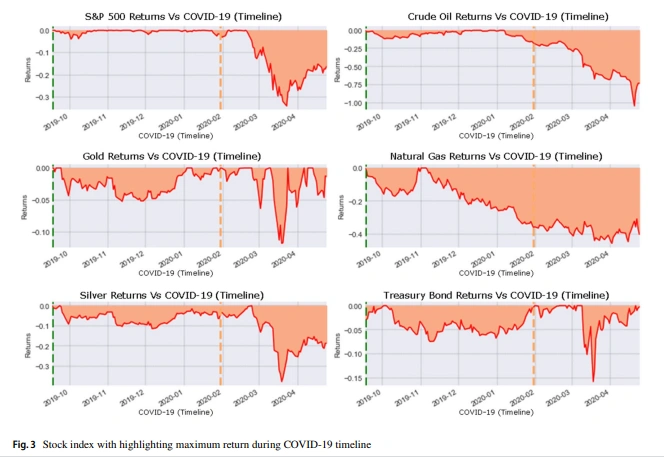

The research conducted by Parag Verma, Ankur Dumka [1] shows the impact of COVID-19 on the economic growth and stock market as well. The aim of their research is to show how well COVID-19 correlates with economic growth through gross domestic products (GDP). In addition, they consider the top five other tax revenue sources and correlate them with the COVID-19, like

- S&P500 (GPSC),

- Crude oil (CL=F),

- Gold (GC=F),

- Silver (SI=F),

- Natural Gas (NG=F),

- iShares 20+Year Treasury Bond (TLT)

Writing a literature review for a research project is a long and complicated process. If you find any difficulty with the writing part, you can get help from Tutors India online literature review service providers.

Tracking COVID 19’s impact on economic

To fulfil the statistical analysis purpose, they used publicly accessible data from the IMF, Yahoo Finance, and John Hopkins COVID-19 map with regression models that revealed a moderated positive correlation between them.

The model was used to track COVID 19’s impact on economic variation and the stock market to determine how well and how long ahead of time the prediction holds true, if at all. The objective is that the model will be able to correctly identify changes a few quarters ahead of time and explain why they are occurring.

Their research on statistical analysis mainly supports policymakers, business strategy makers, and investors in understanding the situation and using the model for prediction.

Tutors India dissertation statistical analysis services online are expertise in handling AMOS, regression, PLS, Bayesian methods, causal inference, hierarchical models. We also help you calculate the sample size, design mock-up tables, figures as part of the statistical analysis plan.

Gross Domestic Product (GDP)

The expenditure method proposed by Atal Incubation Center, EMPI, New Delhi, India [5] The total spending on goods and services by all organizations within a country’s domestic boundaries is measured. The following is the formula for calculating GDP using the spending method:

GDPexp. = CG&S + IB + GP&S + Net Export

Where,

- CG&S + IB + GP&S – denotes the total consumer spending on goods and services,

- IB – denotes the total investor spending on business capital goods,

- GP&S – represents the government’s spending on public goods and services,

- Net export = Export-Import i.e net denotes the difference between export and import

Table 1 Top 10 World Economics of the world with GDP and contribution of world GDP(%), respectively

| Country | GDP($ USD) | Share of world GDP (%) | |

| 1 | United States | $20.49 trillion | 23.89 |

| 2 | Chaina | $13.61 trillion | 15.86 |

| 3 | Japan | $4.97 trillion | 5.79 |

| 4 | Germany | $4.00 trillion | 4.66 |

| 5 | United Kingdom | $2.83 trillion | 3.29 |

| 6 | France | $2.78 trillion | 3.24 |

| 7 | India | $2.73 trillion | 3.18 |

| 8 | Italy | $2.07 trillion | 2.4 |

| 9 | Brazil | $1.87 trillion | 2.18 |

| 10 | Canada | $1.71 trillion | 1.99 |

These countries are the fuel of development, controlling roughly 66.49 % of the global economy (details in Table 1 according to the World Bank’s update, published in July 2019). [5]

Consumer spending contributes significantly to global GDP growth. For example, the US economy has outperformed in recent years, with a major reason being that nearly 70% (two-thirds) of GDP is contributed by consumer spending, while government budgets and business investment contribute 20% and 15%, respectively. According to IMF data, the US GDP is currently at a deficit of 5.9%.

COVID 19 Literature Review Help in analyzing the pandemic’s effects on the international economy

Past pandemics impact on GDP and economic growth

- The study explains the previous epidemics and the effects of epidemics on the revenue-generating regions of different countries, which directly or indirectly affect the world economy.

Literature survey of past pandemics impact on GDP and economy growth [2]

| Epidemic (s) | Fatalities | Studies and methods | Economic losses |

| Infuenza pandemic, 1918–19 | Up to 50 million | [3] Cross-country panel regressions US states data | Overall, GDP growth is six percentage points lower, and consumption growth is eight percentage points lower [4]. Data from the states of the United States: Over the next decade, mortality will have a considerable impact on growth which is expected to become slower. Manufacturing activity dropped by 18% each year, although prompter and more aggressive containment served to mitigate the damage. |

| SARS, 2003 | 774 | [4] CGE model | In 2003, there was a 0.1% loss in global GDP. 1–2 ppt lower GDP growth in China |

| H5N1 avian infuenza, 2003–19 | 455 | Socio-economic analysis using structured interviewed scheduling process [6] | The poultry business, food security, and livelihoods in Nigeria are all under attack from rural and urban groups. 75% of chicken farms stopped ordering, while 80% of households stopped buying and eating poultry. |

| Ebola, 2014–16 | 11,323 | World Bank estimate [6] reports produced by non-profit or non-governmental organizations, government, or industry [8] | The economic burden of the outbreak was estimated to range between $2.8 and $32.6 billion in terms of GDP loss. |

| H1N1 | 13 | Ecomod one-country CGE model [7] Single linear regressions [9] | In the case of a mild pandemic, GDP losses range from 0.5% to just over 2%;While, in the case of a severe pandemic, it is over 2%.Losses of $US2.8 billion in the tourism and pork industries in Mexico. With H1N1 incidence (p=0.048, r=0.37), there is a $US27 million trade deficit in pork. |

(*ppt: parts-per-thousands)

A dissertation literature review contributes 40 % of weight. Hence, more effort should be taken to collect exhaustive, up-to-date literature published from various countries. If you have difficulty in research data collection, you can contact Tutors India literature review service.

Conclusion

The S&P 500 stock index and other assets were heavily influenced during the COVID-19 period . In addition, the S&P 500 stock index has already fallen by 28.67 %. It is currently 12.20 below the September 2020 index value as of April 22, 2020.

In summary, the global economies would be more devastating if the virus is not prevented in the short term since it will eventually cause long-term effects on them. Hence, it is essential that governments and international entitieswork together in the future to mitigate the economic consequences of the virus’s effects.

References

- Brodeur, A., Gray, D., Islam, A., & Bhuiyan, S. (2021). A literature review of the economics of COVID‐19. Journal of Economic Surveys, 35(4), 1007-1044.

- Verma, P., Dumka, A., Bhardwaj, A., Ashok, A., Kestwal, M. C., & Kumar, P. (2021). A statistical analysis of impact of COVID19 on the global economy and stock index returns. SN Computer Science, 2(1), 1-13.

- Barro RJ, Ursúa JF, Weng J. The coronavirus and the great infuenza pandemic: lessons from the “spanish fu” for the coronavirus’s potential efects on mortality and economic activity. National Bureau of Economic Research 2020

- Lee J-W, McKibbin WJ. Estimating the global economic costs of SARS. Learning from SARS: Preparing for the next Disease Outbreak: Workshop Summary, 2004;92–109.

- Obayelu AE. Socio-economic analysis of the impacts of avian infuenza epidemic on households poultry consumption and poultry industry in Nigeria: empirical investigation of Kwara State. Livestock Res Rural Dev. 2007;19(1):4.

- Burns A, Van der Mensbrugghe D, Timmer H. Evaluating the economic consequences of avian infuenza. World Bank Washington, 2006

- Keogh-Brown MR, Smith RD, Edmunds JW, Beutels P. The macroeconomic impact of pandemic infuenza: estimates from models of the United Kingdom, France, Belgium and The Netherlands. Eur J Health Econ. 2010;11(6):543–54.

- Huber C, Finelli L, Stevens W. The economic and social burden of the 2014 Ebola outbreak in West Africa. J Infect Dis. 2018;218(Supplement_5):S698–704.

- Rassy D, Smith RD. The economic impact of H1N1 on Mexico’s tourist and pork sectors. Health Econ. 2013;22(7):824–34. 26. Zhou P, Yang X-L, Wang X-G, Hu B, Zhang L, Zhang W, Si

Previous Post

Previous Post Next Post

Next Post