Economics & Finance

Assignment Writing

- Economic trends in key markets

- Consumption and Service sectors

- Supply chain resilience

- Economic Integration

- Macroeconomic aspects of nutrition policy

- Four Pillars of GDP

- Four factors affecting the business cycle

- Three broad areas of financial decision making

- Merger accounting

- Inventory Audit Or Leverage & Profitability Or FDI

- Profitability Vs FDI

- UK Banking Industry- A Competition Commission’s Banking Report

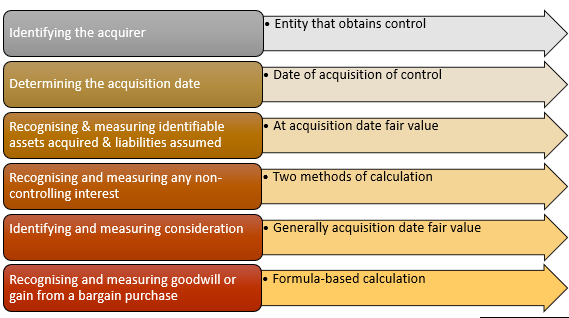

Merger accounting

Merger accounting is a method for managing combined accounts that is more readily interpreted and used in accounting for company reconstructions, including the sale of whole firms to consider shares. The transaction process, in which the agreement is perceived from the viewpoint of the merging party known as the acquirer, is a typical approach when evaluating an M&A. The acquirer takes over the acquiree’s assets, liabilities, and other business aspects relevant to the acquiree’s activities.

Before discussing how to apply merger accounting, it’s important to understand the goals of the method, which are to:

- avoid the recognition of unrealized gains and losses that may result from a fair valuation of the share consideration; and

- avoid the fair valuation of transferred assets and liabilities, as well as the recognition of goodwill, since there is no buyer and no ‘goodwill’.

In the acquisition accounting procedure, the bearing values of the assets and liabilities of the parties to the deal do not have to be adjusted to the equivalent value. Still, sufficient changes must be made to ensure uniformity in the accounting practices of the merging organizations.

The permutations in the form of combined accounts are mentioned in the table below:

| Acquisition accounting | Merger accounting | |

| Shares are under consideration (group reconstruction relief and merger relief might be applicable here). | Fair price

|

Nominal worth |

| Cash or intragroup loans should be considered | Actual worth | Actual worth |

| Transferred net assets | Fair price | Book value |

| The difference between the consideration and the moved net worth | Recognized as a source of goodwill | Not goodwill – reserves have been deducted |

| Recalculate comparatives to account for exchanged revenue. | No | Yes |

| Recognize profit and loss | Post-acquisition only | Pre- and post-acquisition |

Fig.1. Merger Accounting (educba.com)