Economics & Finance

Assignment Writing

- Economic trends in key markets

- Consumption and Service sectors

- Supply chain resilience

- Economic Integration

- Macroeconomic aspects of nutrition policy

- Four Pillars of GDP

- Four factors affecting the business cycle

- Three broad areas of financial decision making

- Merger accounting

- Inventory Audit Or Leverage & Profitability Or FDI

- Profitability Vs FDI

- UK Banking Industry- A Competition Commission’s Banking Report

Three broad areas of financial decision making

The methods of accumulating funds, investing them in shares, and then returning the dividends collected on those investments to shareholders are referred to as financing, expenditure, and dividend decisions. An organization seeks to balance capital inflows and outflows by making these decisions. The types of financial decisions that every company is required to take are:

- Investment Decision

An investment decision is a financial decision that deals with how a company’s finances are spent on various assets. A long-term or short-term investment decision may be made. A capital budgeting decision is a long-term investment decision that involves large sums of long-term investments and is permanent even at a high cost. Working capital decisions are short-term spending decisions that impact a company’s day-to-day operations. It requires decisions about currency, inventory, and receivables levels.

2. Financing Decision

A strategic decision on how much money can be raised from various long-term borrowing streams, such as preferred stocks, preference shares, debentures, bank loans, and so on. This is referred to as a funding judgement. In other words, it is a judgement on the company’s “financial base.”

[ Subject Matter Expertise Help you in Writing the financial decision making research paper or assignment]

3. Dividend Decision

The dividend decision is a financial decision that involves determining how much of a company’s profit should be paid to shareholders (dividend) and how much should be held for potential contingencies (retained earnings).

The portion of the gains that is paid to owners is referred to as a dividend. The decision on dividends should be made with the overall goal of increasing shareholder wealth in mind.

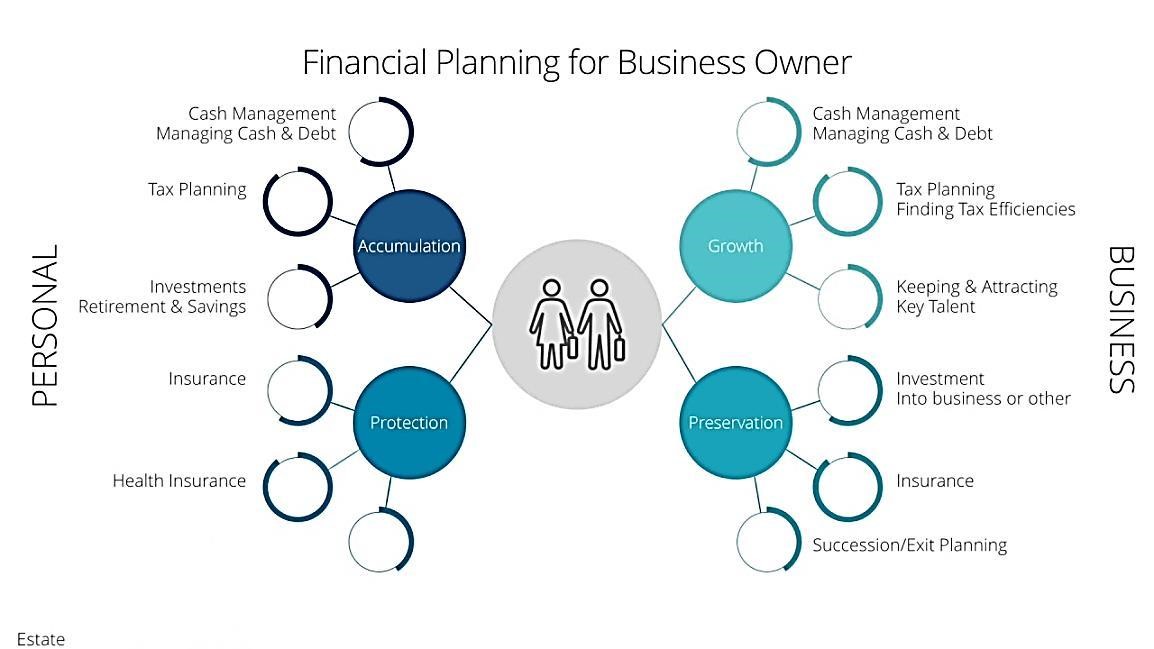

Fig.1. Financial planning for business owner (Prudentasset.com)