Academic Law Writing

PHD Dissertation

- EU Law

- Writing a Master’s Law Essay

- Writing a Master’s Law Dissertation

- What is an LLM?

- UK Legislation of Corporate Crime

- Unconscionable Conduct In Financial Services Of Australian Law

- Canadian Law Of Racial Profiling

- Consumer Protection In Distance Selling

- European Union Legal System

- Doctrine Of Self Defence In International Law

Unconscionable Conduct In Financial Services Of Australian Law

Unconscionable conduct lacks a clear legal description because it is a term that courts have evolved over time on a specific instance basis. If the behaviour is especially harsh or oppressive, it could be considered unconscionable. To really be deemed unconscionable, behaviour is much more than just unfair; it must be against one’s conscience when measured against societal norms. If business behaviour is especially harsh or discriminatory and goes above tough commercial negotiating, it may be considered unconscionable[1].

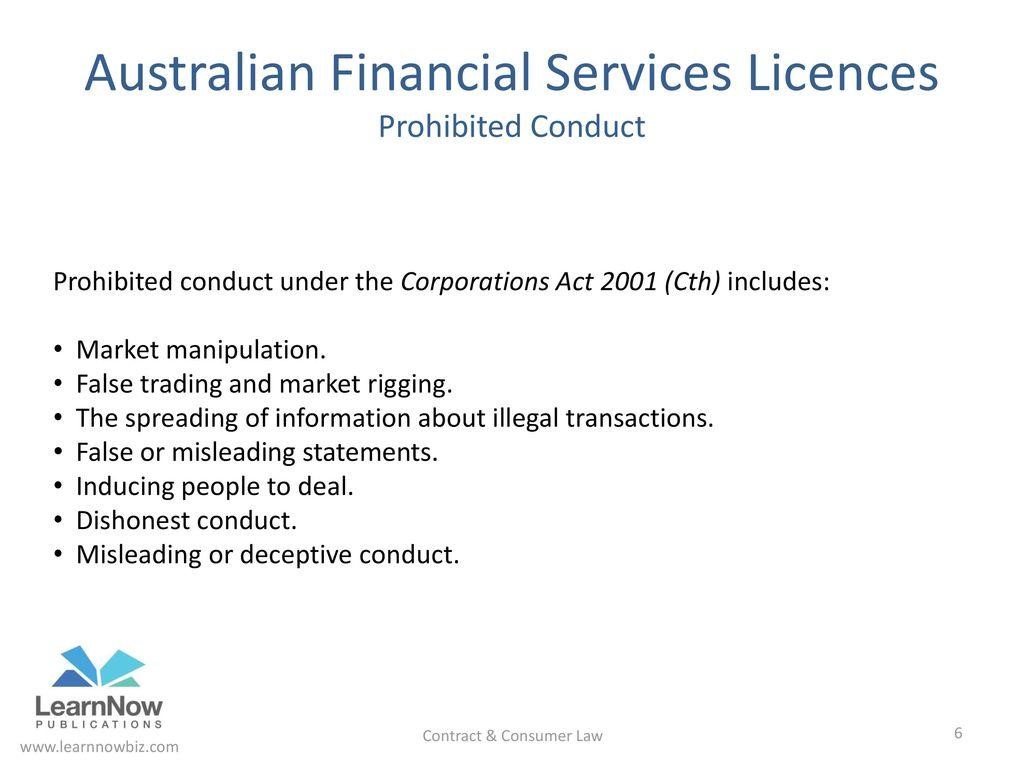

Fig1. Australian Financial Services Licences[1]

For instance, Australian courts ruled that transactions or transactions are ‘unconscionable’ once they are intentional, include significant negligence, or involve obviously unjust and unreasonable behaviour. The Policy Statement explains how to handle unconscionable conduct allegations. It outlines the factors it will weigh when reviewing such allegations, the details it will seek from a customer or financial services company, and the possible solutions, based on the loan provider, broker, or property lender.

Unfair conduct and concerns about reckless lending can also be included in some complaints[1]. The authority in this field is not limited to loans secured by real property or to average customers, notwithstanding the fact that the Position Statement applies to loans and credit cards as they relate to individual consumers. It would apply the same general concepts to a variety of financial items, as well as new business borrowers.